Dear friends,

How’s everyone doing? We’ve printed some mad gains over the last months, didn’t we? I think by now, you understand what 10x Club stands for!

Sure, sure, sure, last bit of 2023 and in January we’ve seen some pullbacks… No big deal, remember - for most coins I make two trades: buy as low as possible (like we did in Nov/Dec 2022 around the bottom) and I sell as high as possible (to be determined).

Bitcoin ETF

So, this week on Wednesday 10th of January 2024, we’ll know if there’s a spot ETF coming. I personally think its a go - especially for BlackRock and potentially some other big parties. Price action has been clearly in the hands of institutions already for the last half of 2023, as option dealers and traditional crypto market makers didn’t manage to bring max pain for both futures and options in the window of opportunities. Simply said: the. big boys bought all the dips and double profited as they were balls deep in call options as well - thus they built substantial liquidity (in Bitcoin) to open up shop.

What if the ETF gets delayed or denied? Probably we’ll see a flash dump towards the 33-38K area where price will find support and we’ll start the show all over again. Actually, it would be even more bullish as the ETF speculation would persist. Anyway, I think it’s a 80% go, SEC already got sued by multiple parties over their last denial. and the judge favoured the ETF issuer. This is a done deal, BlackRock > SEC.

So let’s quickly dive into Bitcoin price action for the coming week/weeks and move on from there to - in my opinion - much more important consequences and upcoming narratives. Important: don’t gamble leverage this week, especially if you don’t have absolute clean track record - it will likely be volatile!

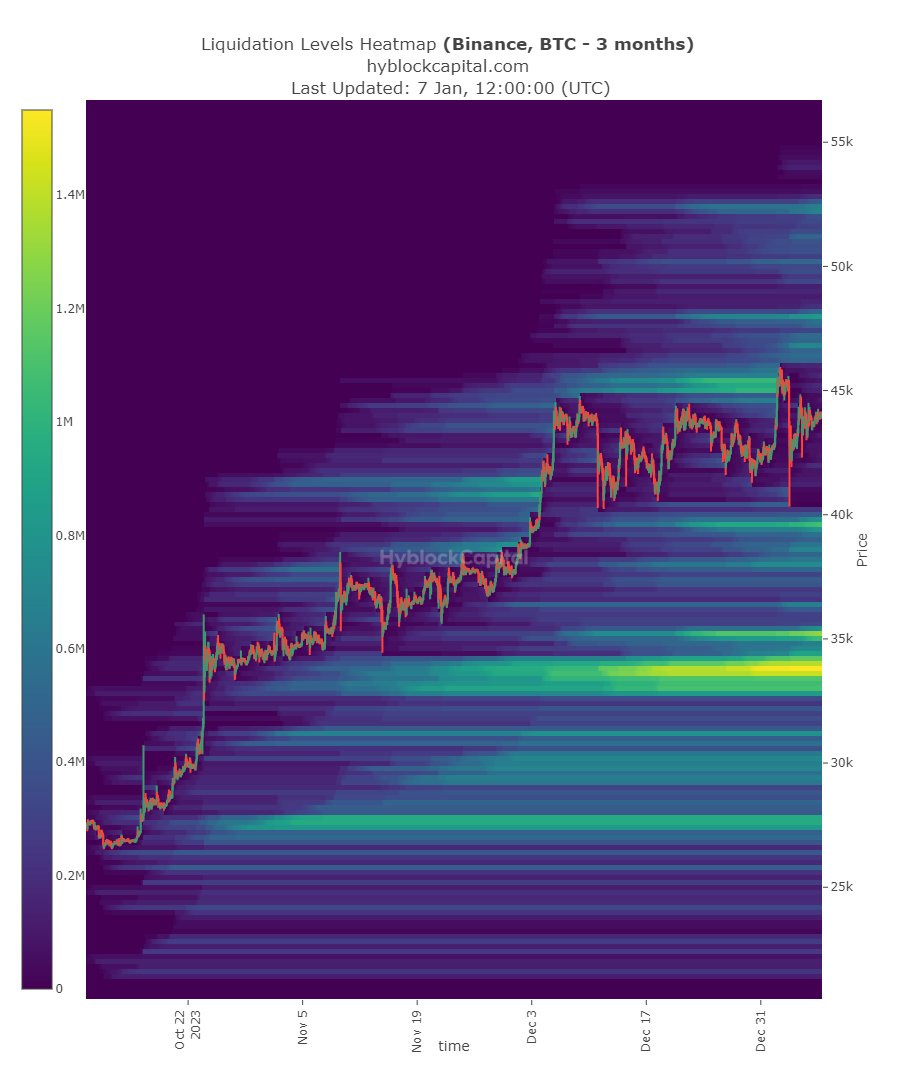

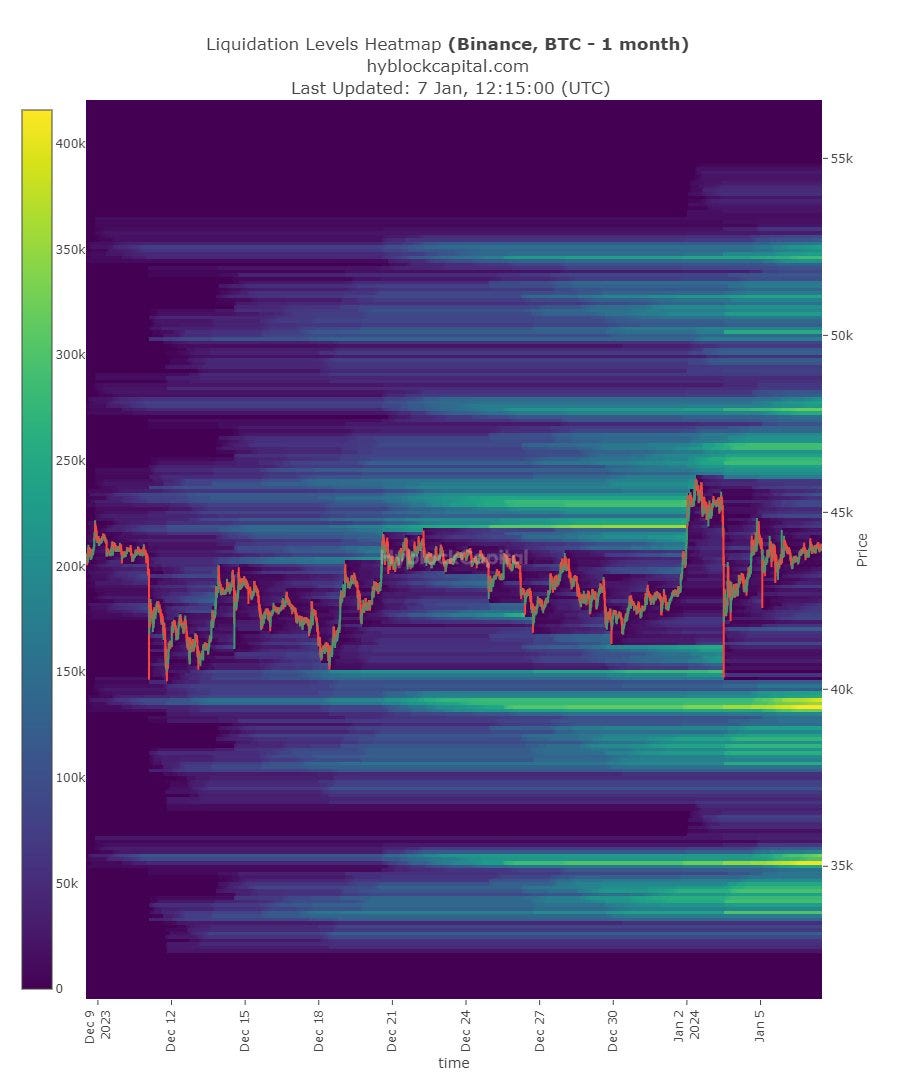

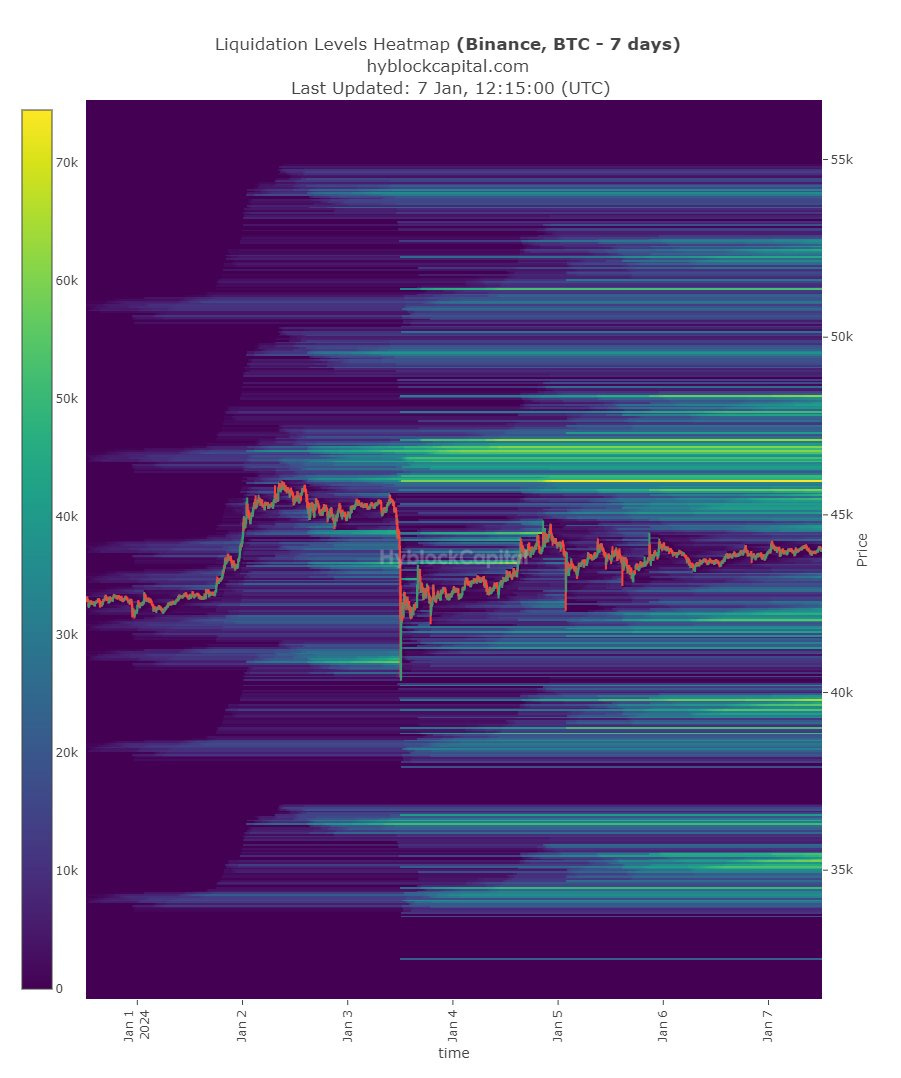

So let’s check $BTC futures liquidations:

Sell The News!

So, I don’t know how many people have called for a sell the news but it clearly shows on the 7 days liquidation chart LOL. I do expect a pullback before we break the current range but I don’t think BlackRock is going to be that stupid to let Bitcoin dump at the start of their show. What happens next month or later, we’ll worry about later…

So, in short; we have billions worth of liquidations at 33-34K, which is too low - the big boys won’t let it happen - unless(!) and I said it before - ETF gets denied. Remember, the big guys aren’t doing market making for crypto futures or options, they don’t care about these pockets of liquidity - its not theirs!

Next up, we have a bag of liquidity just below 40K (1 month chart), and that one is interesting, as its doable. Japan has a bank holiday on Monday, which means low liquidity during Asian hours, and that could mean thin order books and cheap liquidity swipes for the market makers.

Lastly, we are building more and more shorts between 45 - 47K, just above the current trading range and market makers had ALL THE OPPORTUNITY to grab it but didn’t. To me that looks like they’re keeping it there, fueling hope for the bears in order to wipe them out later.

So, here are two scenarios, that I have in mind (obviously crystal ball work here), where I find the orange scenario most likely, but it’s a simple waiting game for Asia’s session to be finished and London to open on Monday morning.

That’s it for Bitcoin, if conditions look good, I might trade it but its not my priority at this very moment. There are much bigger things at play in my opinion, lets continue:

The Institutional Narrative Will Come For Alts

Let’s get beyond the Bitcoin ETF here. Remember when you first invested in crypto? What did you buy? Probably Bitcoin, at least I did - like most others. Then, once you get settled, you see opportunities in altcoins. It’s not a question about if institutions will have the same path but when they will dive further into alts.

Moreover, which alts will they buy?

Well, that’s exactly the portfolio we’ve been building for the last 1.5 years.

Let’s have a look:

Institutional coins

QNT │ CBDC’s, banks, Gov, Standardisation, Interoperability, RWA tokenisation

LINK │ Data feeds, Banks, Gov, Interoperability, RWA tokenisation, DeFi

ETH │ Enterprise, RWA tokenisation, private blockchains, DeFi

HBAR │ Enterprise, Government data, RWA tokenisation, Security

SOL │ Enterprise, Loyalty, NFT’s, Consumer markets

AVAX │ Enterprise, Loyalty, NFT’s, Consumer markets, DeFi

ALGO │ CBDC’s, banks, Gov, Digital Currency / Commercial stablecoins

EWT │ ESG, climate, energy market, enterprise, Bitcoin mining offsets

MNW │ Supply chain, Enterprise, Standardisation

XDC │ Enterprise, Trade, Finance, Banks

DAG │ Data, Security, Gov, Enterprise

So, here’s my view, there will be at least 4 projects from the list above that will be in crypto’s “magic 7”. You probably never heard anyone in crypto talk or even think about that, but it’s been my focus post-2021 bull run. What are the long term winners within the crypto space and which projects will blow up to become leaders of the space? We don’t know, apart from Bitcoin and Ethereum, but we can diversify and catch a few of them to the upside! Those will be big runners, a 100x is a possibility.

But you’ll need patience, a potential magic 7 of crypto will only solidify towards the end of the decade and beyond the current cycle. Lets look at some other categories:

AI, Data & IOT coins

TAO │ AI

RNDR │ Decentralised computing

FETCH │ AI

AR │ Decentralised storage

IOTX │ IOT

Hype Coins

Solana Ecosytem │ ORCA │ NEON │ RAY (sold) │ new additions: SHDW, LFNTY

Injective Ecosytem │ INJ │ NINJA

SEI Ecosytem (new) │ SEILOR │ scoping more…

We’ll dive deeper next time, Asia just opened, let’s push this out.

Wish you all well,

BlowOffTopic