Hi guys,

Hope you’re all doing well even though we got hit substantially in our unrealized PnL. As I always say, spot and chill - and you can’t get liquidated. In this post, very short, why we experience a market wide correction: options expirations.

We have options expirations on all indexes: Nasdaq, S&P500 and of course ETH and BTC. I’ll focus on ETH and BTC but the story remains the same: very high open interest across the board, especially in calls (long), which makes that option dealers have been selling heavily to avoid big payouts. Also, the end of the year expirations are always the biggest ones in open interest and thus trigger bigger corrections. The options have expired this morning, wiping the books, which results in buying pressure. Yet, there’s one last opex to do on Dec 27th for crypto which somewhat less significant as the one of today.

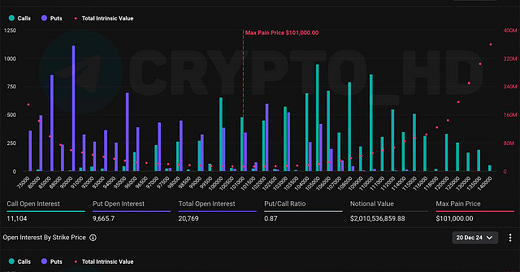

Today’s OPEX

Option dealers choose violence and pretty much rekted ALL calls (longs) on both BTC and ETH - once a call contract is below strike price at expriration: it’s worthless, goodbye money. Just the puts (shorts) did well, but as you can see they are notably lower in open interest than the calls.

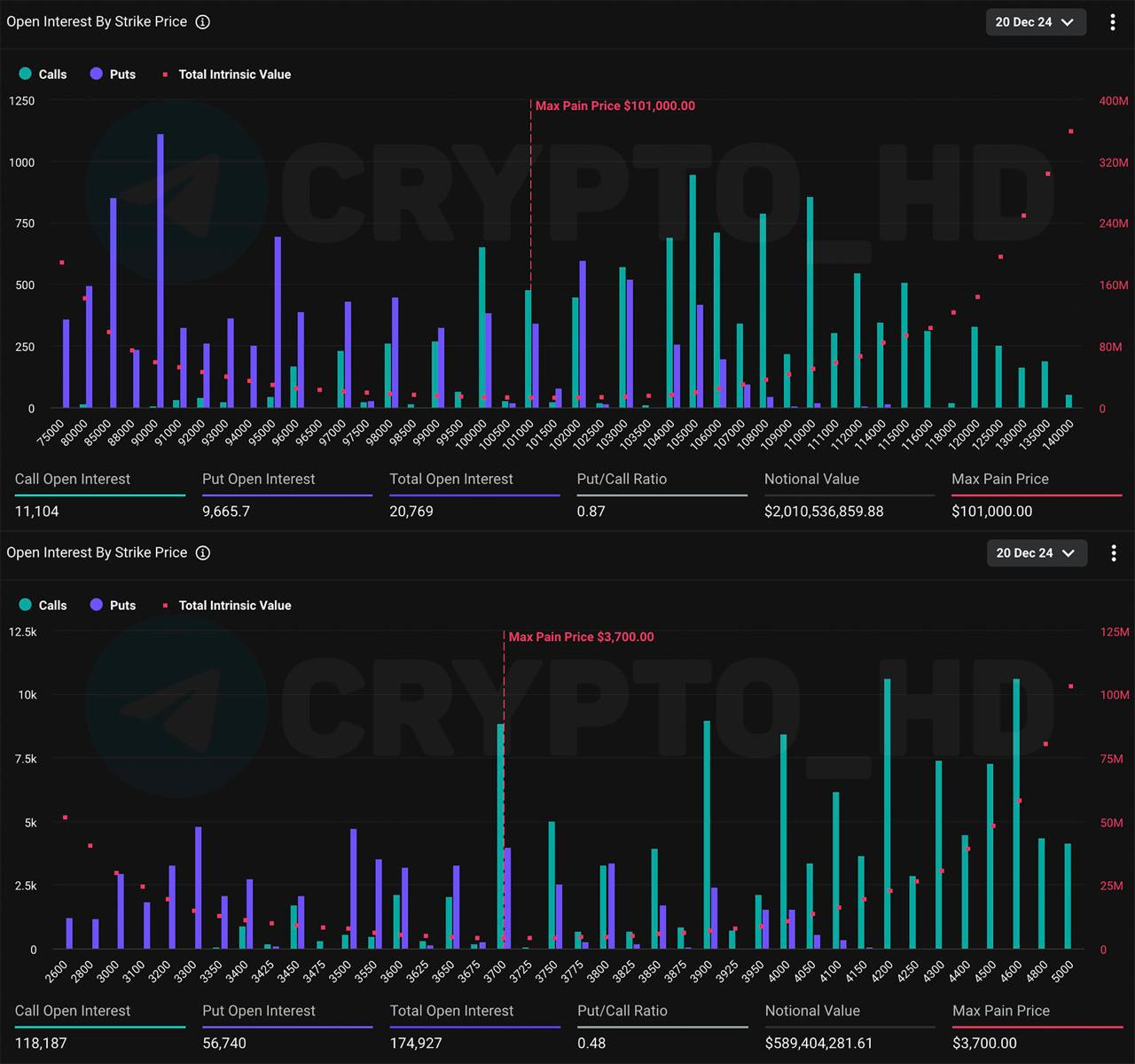

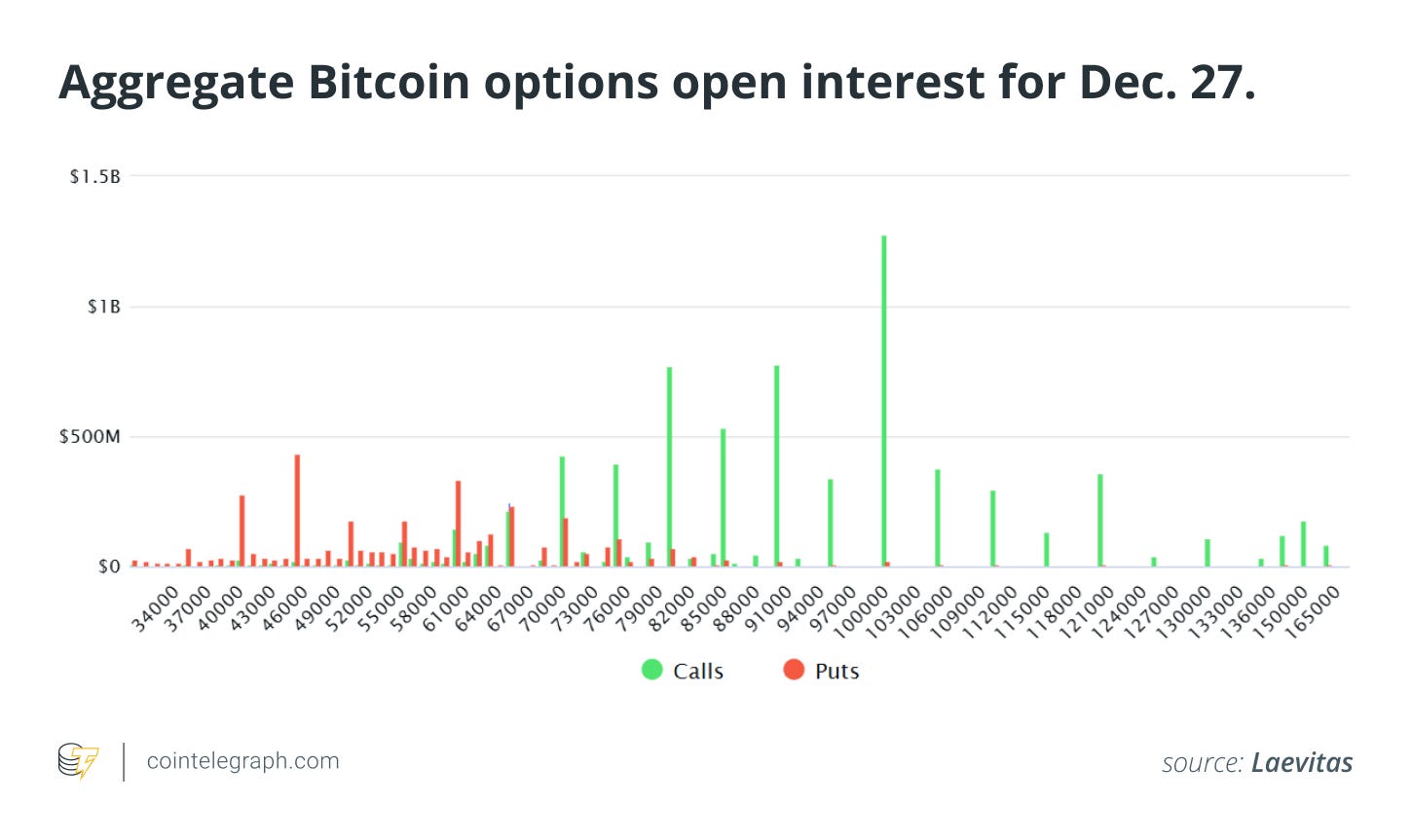

Opex on Dec 27th

Now we go onto the options expiry of Bitcoin for December 27th, we see a similar picture with many calls above $70,000. Yet here are the stats:

$BTC Notional: $1.99B | Max Pain: $102K

$ETH Notional: $590M | Max Pain: $3,750

This means, max pain is above us, which should entice option dealers to start marking up price - yet it’s not a given! They could also choose violence (again) and take out all calls. Yet, after this date, we flushed most leverage and open interest - so this should give us clean books to start the new year.

Risk of Recession

Generally I’m bullish for crypto in 2025, as we have a new administration and SEC that will be pro-crypto. Bloomberg Senior ETF analyst Eric Balchunas expects many new crypto ETF’s next year: BTC & ETH combo (filed), then LTC, HBAR (filed), then XRP and SOL. He was already right on the BTC & ETH combo ETF and he knows better than me, so getting a possible HBAR ETF would be insane! Funny enough, I was joking with this dude on X. lol

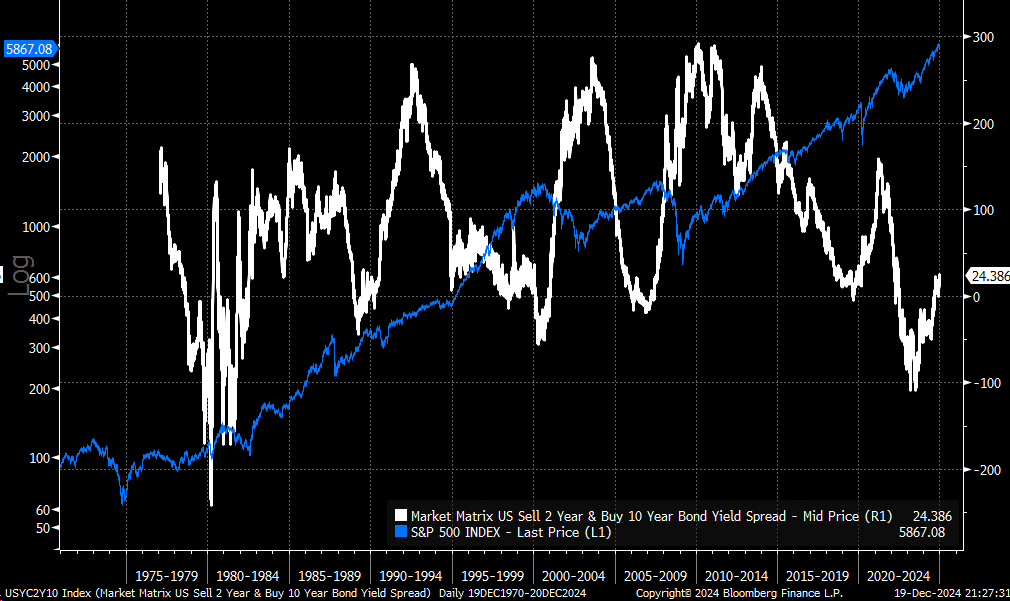

But our risk is mainly macro, if(!) we get a recession and uninversion of the yield curve we might(!) be up for a Covid-style crash. The uninversion is happening now, which is a big warning - but only as the curve steepens we expect a drawdown. This is still too speculative for me to act on it right now, but remember - investing comes with risk, that you carry yourself - so being exposed to this market comes with the gains and the losses. This is where we are now:

Currently, the US economy is still robust, but earnings are coming down and are signaling a weakening economy. The Fed has been too soft on the market during 2022 - I said this! - and now projects only two rate cuts during 2025. I would have rather seen the Fed being mega hawkish during 2022, get rid of most of the inflation / stagflation risk and then run things back to normal. But nope, they choose a “soft landing approach” letting the market run rampant and now are looking to dump into bullish territory to “ease the pain”. Not a big fan of this approach as it comes with real stagflation risk, meaning: recession AND high inflation, no bueno.

For now, there’s nothing else to do than monitor the S&P 500, Nasdaq and the Dow Jones on possible break of a bull trend. Currently, we’re still well above the bull market support band - even dipped below earlier this year for a shake out, thus not the most accurate indicator either. Preferably, we get decent distribution next year, with a somewhat flat top of sellers, similar to 2021, which will give us time to get out of the market - but(!) sometime, this time is not warranted. Hopefully, the new administration throws some bullish cards on the table and the Fed eases somewhat on it’s more hawkish stance.

S&P500

The S&P500 is still in it’s uptrend and currently approaching support. It could retrace the green vector candle in order to shake out and continue - a drop below 5700 would be a warning sign.

Dow Jones

Dow Jones, same story, has a bit more room towards support and this index cares even less about the bull market support band. Above 41,500 is ok, below is a warning.

Nasdaq

The Nasdaq (US-Tech 100) looks best of all three, well above support still. Could drop into the weekly 50EMA and still be ok, which sits around 19,000 - a drop below is a warning.

Conclusion

Overall, this is a healthy pullback flushing leverage out of the system - which is usual at the end of the year. Yet, we remain cautious for recession risk. Right now, it’s simply too early to call anything. Yet, if you’re sitting on good gains and can NOT afford to lose them, please take profit, exit and don’t come till next bear market. This is fully up to you - as again - I’m not a financially advisor! I just share my opinion and right now, I’m sitting in spot and I personally will wait and see what next year brings. Generally speaking, we’re still not in a supportive environment from the Fed (money printing and lower interest rates) while the market is already trading at all time highs, thus is this relatively bullish. It is however to see, whether the market has been too optimistic…

For now, I wish you all happy holidays and all my blessings for 2025 - for the holidays it’s not a time to be busy with the market. Log out and be with loved ones.

Bless,

BlowOffTopic

Thank you BlowOffTopic. very interesting article as always. Looking forward to read the next.

Happy holidays to you.