The Double Squeeze & The Lost Bitcoin

Navigating the battlefield of mercenaries and missionaries.

With the storm of last week behind us, it is time to make up the balance. We have seen a volatile month of May, something I have seen coming for a while. While I’m writing this, Asia just opened for a very interesting third trading week the month. In this post we’ll dive into what we could expect this week and we’ll try to understand where we stand in the grand scheme of things.

First though, I would like thank everyone for subscribing the infamous 10x Club. I hope this could be the start of a great journey for us all. Even though the name of the club sounds we’ll be going on yet another moon mission in the crypto market, I want you to understand that this club will be much more than that. Together we’ll learn the fundamentals of the market, human psychology (especially getting to know yourself) and how to deploy capital for personal gain. Trading or investing is a zero sum game, you either win or you lose. Your PnL is binary — the number either ticks positive or negative. It’s important to understand that you should approach the market like a mercenary, but with the wisdom of a missionary. With this newsletter I will do my best to turn you into both.

You must be thinking: “Another Paid trading community?” “Another influencer?”

Powers of the Omnipresent Mind

I will not be your “influencer” or your “oracle”. And even though I will provide you with research and analytics, I won’t be your “signal” to place a trade. What I will be is your eyes and ears in the crypto market. I saw the Luna / UST drama, I saw the Bitcoin crash, I saw the strong dollar and I saw the liquidations. Truth is, I don’t see everything. I can not. But I can say I see a lot and above all I understand a lot. To become profitable you need to be able to see the grand scheme of things, the things mentioned above are just temporary noise. With a background in journalism, research is my thing. With experience in the start up industry, innovation is my thing. With positions in marketing, analytics is my thing. With projects in music and film, creativity is my thing. Blend them up all together and you suddenly find a profitable trader in yourself.

Now, you might think, where’s finance? Economics? Well, they are blatant terms for human psychology — not science. Science is predictable with the outmost accuracy but human behaviour is not. In the world of economics, finance and trading, you are being thrown about with an abundance of difficult terminology, abbreviations and Alfa’s (read: guys in suits) that tell you; “you don’t understand”. They’re right, you probably don’t, but there’s a difference between what you need to understand and what they have put themselves into.

As a trader it’s most important to comprehend human behaviour and how "guys in suits" make advantage of it. It needs to sound complicated, boring and hugely impossible for you to ever become a profitable trader. So, don’t worry - "guys in suits" will manage your capital, for a fat fee of course. No longer. With this newsletter I will guide you through the financial jungle and we will cut through the noise and get a basic (but sufficient) understanding of how money and the market actually works. All of that in plain and understandable English and explained in a way even a child of 10 could understand it. Next to that we’ll look at where the opportunities are in crypto, and there are plenty - especially during a bear market.

Chaos in the CBD, ORAA!

It’s chaos in the central business district and there are a lot of events that coincide to create that panic and disorder. There is Covid and its effect on supply chains, especially in China - the factory of the world. There is the quantitative tightening, where the Fed (the central bank of the USA) raises interest rates. Both topics will be addressed thoroughly in the 10x Club but for now I will stick to the most important of this week: geopolitical tension and war.

Before I address this topic, I first want to point out that this newsletter will have no political color whatsoever. As a trader, I have no opinion nor influence on politics. I can only be an observer, research what decisions could be made by policy makers and analyse how these decisions could affect my portfolio. I bring no emotions or opinions into the market as they will hamper my performance and my PnL. I do just four things: observe, research, analyse & act, ORAA!

Keeping Track of the Power Plays

Now, I wish I had never had to write about war in this newsletter, but unfortunately I have to. If we observe the situation in Ukraine and especially how the West is reacting upon it, we see an escalatory approach. With Finland and Sweden actively pursuing an application to the NATO, we might have yet another two countries neighbouring Russia to choose this route. If we research predecessors choosing this pathway, like Ukraine, we can’t speak of a succes with regards to national security. If we align the comments from the Kremlin with that research, we can conclude that it leads to power play.

For Russia, the power play lies within the energy market: oil and gas. Now we see where this enters the realm of our portfolio. What would be a power move? Well, Russia could not export gas or oil to Europe or cut supplies severely. The result would be shortages and exploding oil and gas prices. This would create a ripple effect across the markets. All products and services have a cost basis on oil usage, the world runs on oil — left, right and center. If(!) such scenario would occur somewhen in the future, it would be devastating for the markets across the board - bottom callers would feel like top buyers. Everything would get much more expensive, thus creating inflation and it will put even more pressure on the Fed to drain as much dollars from the market with their monetary tightening policy. In all simplicity, the Fed drains the supply of dollars in the market by making loans more expensive and bonds more lucrative. You could see a bond like staking in crypto; you give dollars to the Fed and they lock them away and give you a yield (or percentage of interest every year).

USOIL - Decreasing demand

The oil price crashed almost 100% during the first lockdown in the United States. In some markets oil even went negative. With drained demand from worldwide lockdowns, oil was in a severe bear market - although, it recovered quickly.

USOIL - Increasing Demand & Inflation

The oil price has been rising sharply since the end of 2021, today’s price of around 109$ is a 74% increase from December lows. Increased demand after reopening societies has driven demand combined with record inflation, oil is in a bull market. Another sharp impulse came just after the start of the Ukrainian war. Oil is is consolidating around its highs and does not show signs of a reversal down (yet). Of course, the dollar is an important factor for the market - the stronger the dollar, the weaker the market. If oil prices continue to rise, the Petrodollar will follow - putting more pressure on the risk markets (equities & crypto) and prices will drop. Even though I pointed out the potential reversal of the DXY (the dollar index), fast rising oil prices will take the dollar with it as most of the oil supply is paid in dollars - thus creating more demand.

What to expect of the crypto market going forward

Now with that risk in the back of our head we can move forward to crypto. By all means, there’s not that much to be “bullish” about mid or long term. The outlook is grim, the Fed won’t stop their interest rate hikes anytime soon and inflation is still at record highs. CPI (consumer price index) came in hot last week which was also something I expected. This means I do not position myself towards the upside, I also haven’t been positioned long in the market since late November. Instead I have been diamond handing the USD which has proven to be the right strategy - risk is low and I have seen double digit percentages for my portfolio. Even though I did not increase in dollar value, I did increase my buying power by an average of 60% for the crypto market. Bear markets are all about capital preservation, bull markets are all about capital growth. In 10x Club this will be a key focus point: buying opportunities in the markdown phase (bear market) and selling opportunities in the markup phase (bull market).

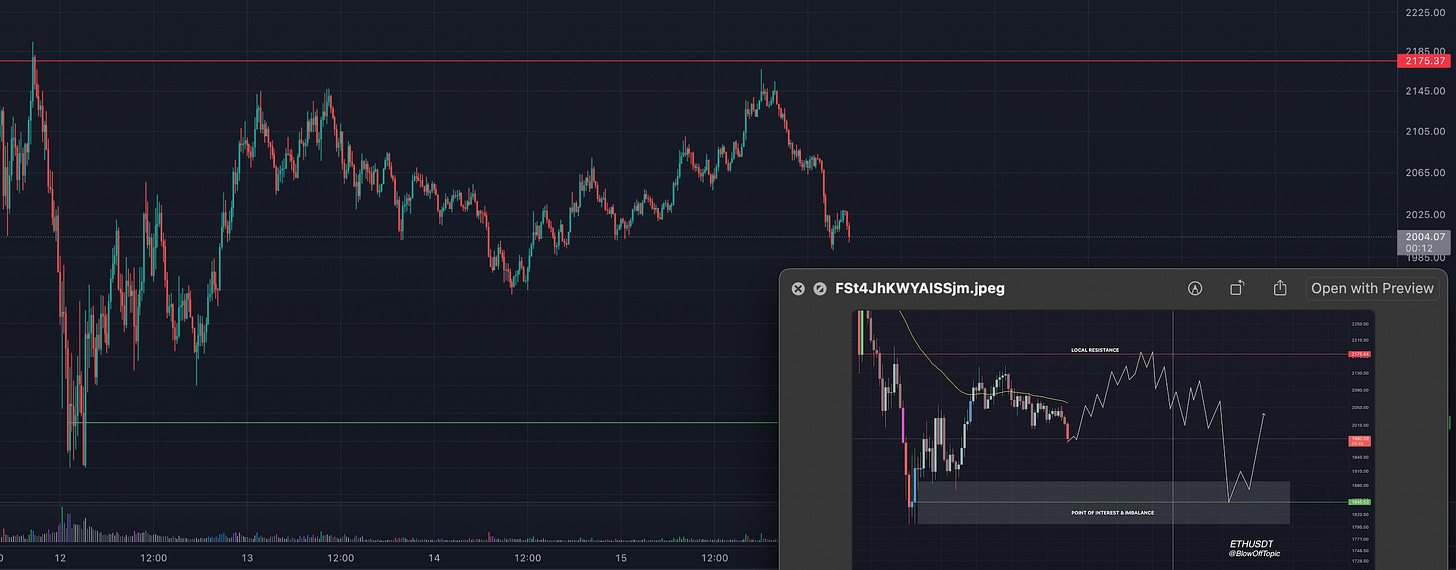

So, long term (still) looks grim, let’s switch to short term scenarios. Given the steep drop to the downside, a short term rally (or short squeeze) could be possible. Over the weekend I projected a scenario that has played out thus far. We have seen a little rally over the weekend in order for the Asian market to bring prices back down. Even though this might not look “bullish”, it actually is. If we look at Ethereum, which is together with Bitcoin - a main market indicator, we can see that ETH-USDT set a new local high over the weekend signifying market maker’s interest towards higher levels. Next to that, we can see that we are currently retesting the lower bound of the range around 2,000$. A drop towards the swing low area, where our point of interest resides, will be crucial to understand what we can expect of this week moving forward.

Ethereum - Imbalance at Swing Low

As you can see, my projection played out pretty well thus far. This is not a matter of coincidence or a “lucky guess” - it’s a matter of looking at data and applying analytical thinking - in short: think like a market maker. After following thousands of hours of price action for especially Ethereum and Bitcoin, I can dream the algorithmic trading systems of market makers in crypto. In essence, the truth lies in today’s (May 16th) New York session and how price behaves at the point of imbalance - if(!) price moves to that zone. Remember, trading is always a game of probabilities, even though this projection plays out now, it could be thrown out of the window by a multitude of factors! (remind yourself of what I wrote in the paragraph above) There’s never certainty in the game of trading, just probabilities - therefore always prepare for any scenario. To conclude, an impulse of Ethereum (and Bitcoin) rejecting the point of imbalance, could be seen as short term(!) strength - or in trading terms, you could call it a double bottom.

The Lost Bitcoin

The last point I would like to discuss is LFG (the foundation behind Luna), Luna and UST. First off, it’s terrible to see retail investors getting rekt by this and it’s not the first time! This is literally why I’m here writing up this piece - to help you. Luna’s tokenomics and its mechanisms for pegging UST have always been a topic for discussion. Analysts that know how to use a calculator knew it was a very fragile system. Therefore I never came near to the project and given the behaviour of its founder: Do Kwon - you could see why I did not trusted the project. Though Luna was an industry mover, the crypto market was poised to go down - even without this black swan event - I did mention this many times and explained this thoroughly in my last YouTube video on April 30th.

Now without making this too complicated. Luna was doing great, the token price was keeping up with the reputation of its branding and the ecosystem was flourishing. Yet, Luna overplayed its hand with the amount of UST issued. The market cap of UST did a whooping 10x in about eight months. Even though we’re the 10x Club, this is not the kind of 10x’s we like to see. So in short: too much UST, too little backing.

UST - Market cap

Do Kwon should have known this and maybe that’s why he started to buy large amounts of Bitcoin at the start of 2021. He might thought to strengthen trust in UST and backing it with the most “trust-less” decentralised network should maintain calm waters. He was wrong. Not only did he buy Bitcoin at a premium (high price compared to current day), his actions created a new stir in crypto - asking new questions around the policy of LFG. Buying Bitcoin ment speculative backings of something that should stay stable: a dollar stable coin. Do Kwon’s comments confirmed this stance:

This what I say all the time for investing and trading: don’t bet. Yet, Do Know did exactly that and not with his own money, but with the money of millions of Luna & UST investors. This was meant to go wrong! Making an already fragile and unsustainable economy even more dependent on speculation and “betting”. We can now write off his bet, as it played out in the wrong way. UST saw a massive exit of investors and it lost its peg. Kwon did everything to save the show. He knocked on the doors at his wealthy investors, he loaned out his Bitcoin, he sold his Bitcoin and the protocol minted massive amounts of Luna - all to feed the dollar reserves that back UST. UST lost its peg and currently trades at 8 cents to the dollar and Luna wiped out almost 100% of its value - everyone lost. Luna investors and even Bitcoin investors became exit liquidity and as always with this term (which we will cover more extensively later on), the exit out of the market is a small door, compared to the the huge and welcoming entrance. Until here, the Luna story, now let’s see what this means for the market and our portfolio - ORAA, remember?

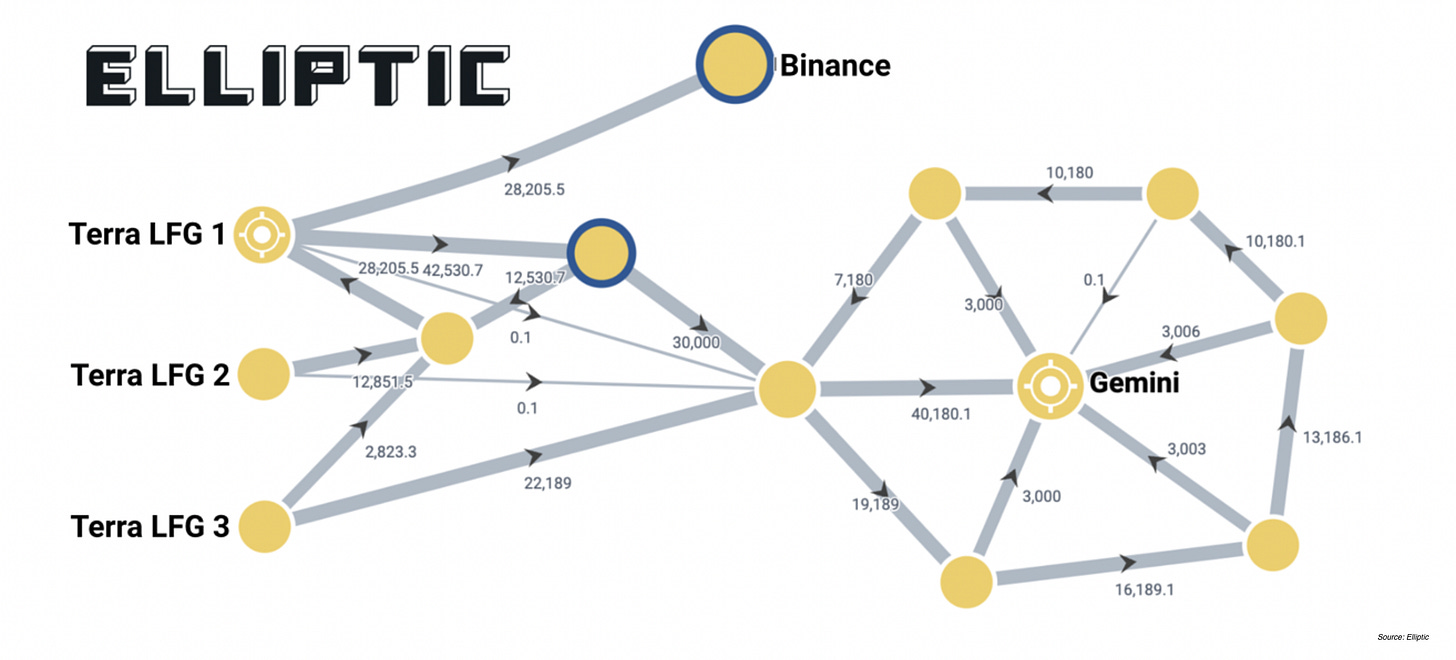

LFG’s Bitcoin returned to the market maker

With the help of the amazing research of Elliptic, give them a thumbs up, we can see that at least the majority of LFG’s Bitcoin returned to the market maker. This also coincides with the massive amount of inflows I noticed during the first weekend of May. A chunk of that Bitcoin was sold off on spot exchanges and another chunk of it went to Gemini’s institutional trading desk or OTC (over the counter). In general, there’s nothing more lucrative for a market maker than a liquidation - in essence, it returns free Bitcoin to them that was sold at a premium, win-win. Selling this Bitcoin off on spot and thus liquidating millions of retail long positions makes it a win-win-win. That’s what market making is about — the route to maximum efficiency and return on investment: the mercenary at its finest. The missionary, that was Kwon, lost. And so did all the retail investors that were heavily biased to only one direction: up.

To conclude, the Bitcoin wasn’t lost. It flowed back into the capable hands of the market maker. First signs of outflows have been spotted over the weekend - Coinbase saw around 10-15K of outflows of Bitcoin - which could indicate OTC deals. Coinbase is indeed one of the most popular places for institutional deals. The OTC market will come into play more prominently when 2022 and its bear market progresses. The double squeeze is still in full swing! A likely scenario is first to take out the shorts and puts in both the stock and crypto market - getting everyone’s hopes up for a reversal - before resuming the markdown phase. The latter comes with the greatest opportunities. Buying a bear market bottom on both the crypto and the stock market is proven lucrative — we are called 10x Club for a reason. Yet, finding the bottom remains difficult and I do not want to make predictions or bottom price targets - instead: ORAA. One interesting quote I observed is a quote of Josh Lim, the head of derivatives trading at Genesis:

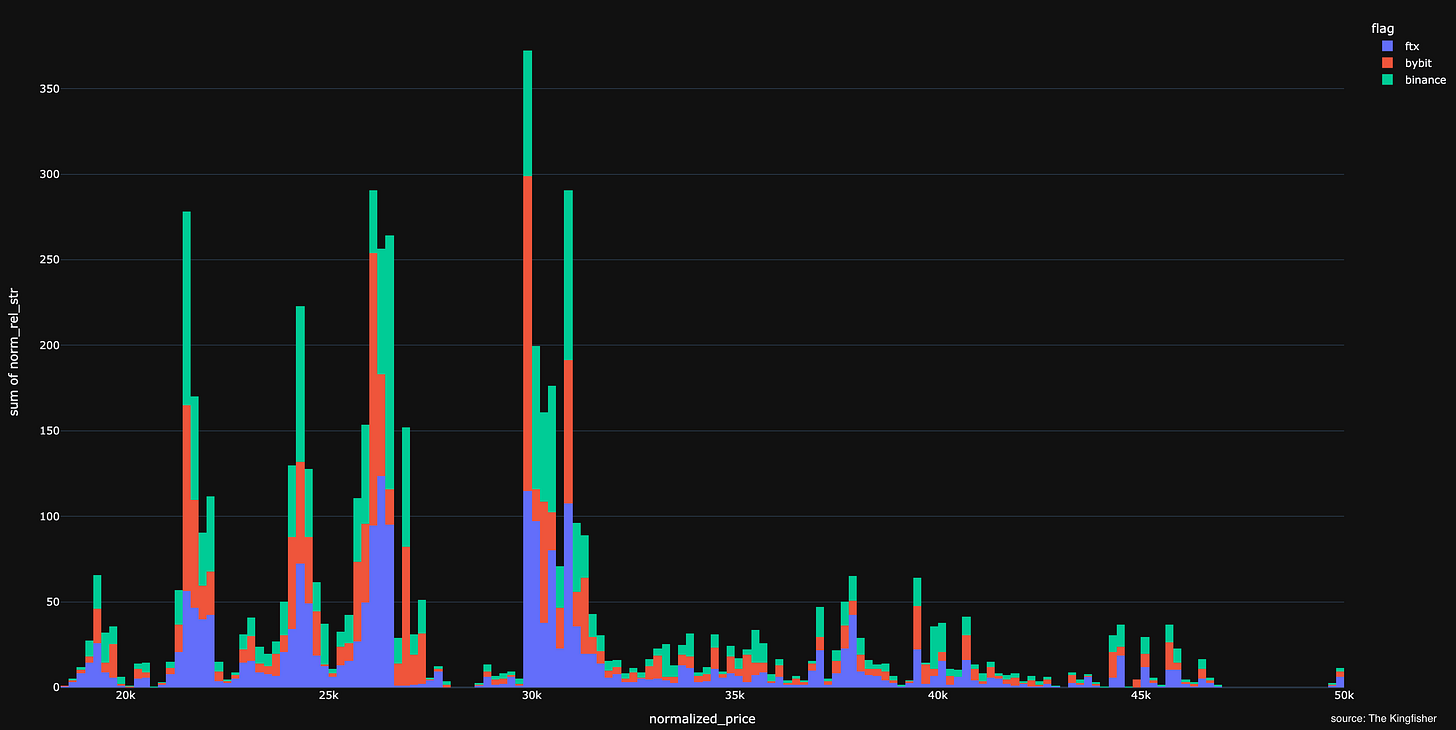

In conclusion we can say that it’s likely we have not seen the end of the mark down phase. Of course many "experts" are screaming bottom, but how neutral are their views? Or how correct were they in the past with their calls? Even the words of people working in crypto market making, as seen in the picture above should be taken with a grain of salt. For that matter, everything that I write should be fact checked - that’s why I always encourage you to do your own research - but let’s say I’m trying to help you looking for the right things in the right places. What we do know for a fact, is that market makers love liquidations - it’s not a coincidence that leverage trading (up to 125x) is heavily advertised - especially by influencers (paid by exchanges through referral links), and exchanges who work directly with market makers. Thus, if we align the macro outlook (markdown phase) with a double sided squeeze - we can see that a Bitcoin price of below 30K USD, will put many institutions underwater and if we look at retail leveraged positions, max pain is felt at the mid-twenties - as seen in the liquidations chart (of last week) below:

Bitcoin - Liquidation Levels

With growing geopolitical unrest and financial tightening, long exposure remains to growth markets (equities & crypto) remains an high risk trade. With the New York session of Monday 16th of May, opening as we speak - we can make up where we stand. A confirmed break of 29,400$ on Bitcoin could lead the way towards the point of imbalance between 28,600 and 27,000$ - the reaction at these levels will be pivotal. Although, a direct shift upwards (into a short squeeze) can not be excluded from the current price of 29,750$. For Ethereum the story is exactly the same - a confirmed break of 2,000$ could lead into the point of interest between 1950$ and 1800$. Short term long trades could be considered at these lower zones, if(!) these levels hold and the market shows a rejection upwards. However, this market is high risk in any direction! Lastly, this would coincide with the S&P500 filling the gap between 3965 and 3930. The first target upward for Bitcoin would be 34,000$ but it has to hold support above its current swing low - breaking below 27,000$ would take all the trades off the table and will bring us right back to ORAA — and I can not emphasise enough that “Act” is the last verb in this abbreviation.

The battlefield of mercenaries and missionaries continues.

Very informative article. Thank you.

Very nice article, Thank you for this.